Strengthening your supply chain one link at a time.

Strengthening your supply chain one link at a time.

Inflation continues to dominate the Federal Reserve’s Monetary Policy. The target rate of inflation by the Fed is 2%. Thus, an inflation rate above 2% will compel the Federal Reserve to keep interest rates higher with the goal of slowing down the economy and weeding out inflation. Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power.

Breaking down the PCE Index

The Personal Consumption Expenditures (PCE) is a monthly economic report from the Bureau of Economic Analysis. The PCE Index is a key inflation measure used by the Federal Reserve to track changes in consumer prices over time. It reflects the price changes in goods and services purchased by households in the U.S.

The PCE Index is categorized into two major sectors based on household consumption: goods and services. These categories provide insights into inflation trends across various economic sectors. Each category is further divided into subcategories for a more detailed analysis.

Goods – Tangible products purchased by consumers.

Services – Intangible expenditures on experiences or work done for consumers.

Inside the PCE Latest Numbers

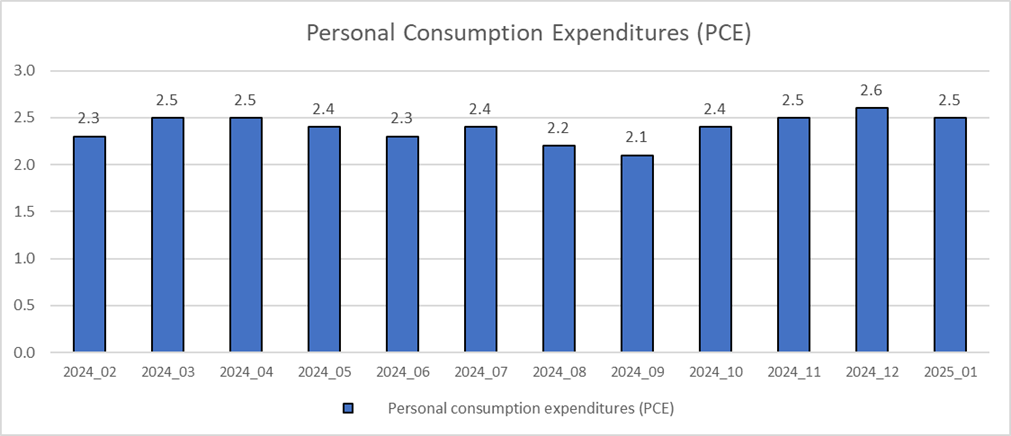

The February PCE number came in at an annual inflation rate of 2.5%, which was down slightly from 2.6% in January. The PCE percent change for February came in at 0.3%, which was the same as January. The February release came in as expected by economists. The PCE Index is the preferred measure for inflation for the Federal Reserve.

Breaking down the PCE Index results

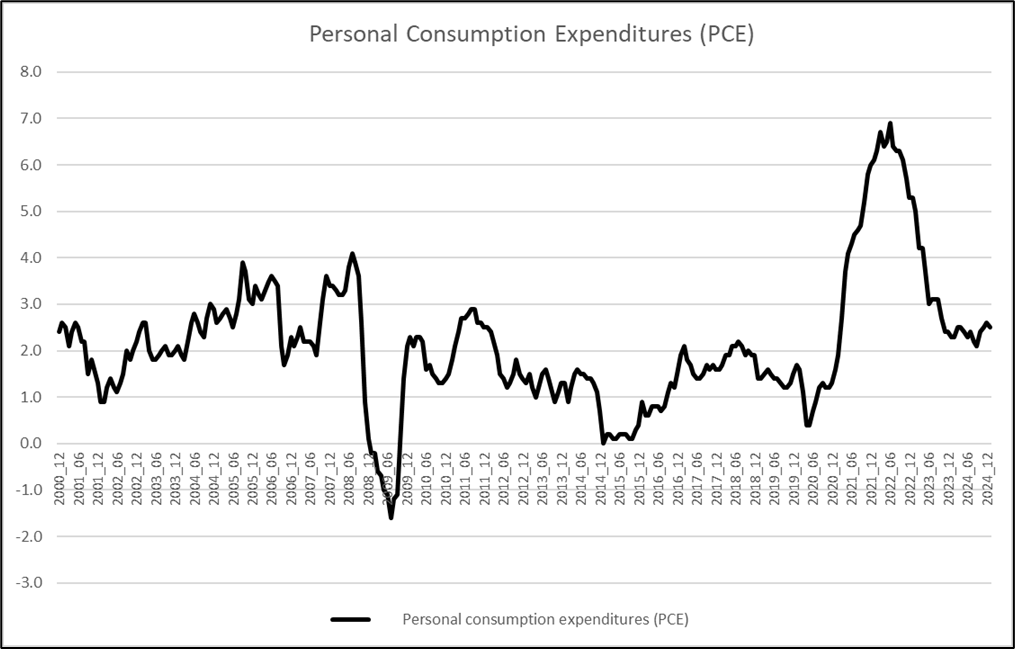

Below is the PCE Index from January 2000 to January 2025. One can see that the Federal Reserve has made good progress since inflation hit an annual rate of 6.9% in June of 2022. The annual rate as of the February PCE release is 2.5%.

Since September 2023, when the PCE stood at 3.1%, it has remained stubbornly between 2.1% and 2.7%. Further analysis is needed to understand why the PCE has not decreased further toward the 2% target, which would enable the Fed to reduce the Discount Rate from its current 4.5% level.

Breaking down the PCE data into the Goods and Services categories offers more insight. The Goods component of the PCE saw a sharp increase in 2022, peaking at 10.1% in March. For the entire year of 2022, the Goods PCE was 8.3%. However, since that peak, the Goods PCE has fallen significantly, with the most recent reading for February showing an annual rate of just 0.5%. This indicates that price increases for Goods are now under control.

Examining the Services component of the PCE tells a different story. It reached a peak of 5.9% in 2022 and early 2023. However, unlike the Goods component, it has not declined as quickly. As of February 2025, the Services component of the PCE stood at 3.4%.

Housing and Financial Services Influence on the PCE

Breaking down the Services PCE component further reveals the key subcomponents contributing to the slow rate of decline. Two primary factors stand out: The Housing and Utilities component and the Financial Services and Insurance component. Both have played a significant role in keeping Services PCE elevated, thereby influencing overall PCE as well.

Since the point in time November 2022 when the Goods PCE moved below the Services PCE, the Services PCE has averaged 4.5% annually. Two categories, Housing and utilities at 4.2% and Financial services and insurance at 5.0% have proved to be the main categories keeping the Services PCE higher relative to the other components of the PCE.

The lingering effects of COVID-19 continue to impact the housing market, with supply and demand imbalances exerting pressure. Housing insurance is related to this increase but also there has been a run of weather disasters that has created its own challenges. Auto and medical insurance has also seen stubborn price increases.

On a positive note, the Services PCE for February 2025 came in at 3.4%—its lowest level since March 2021.

Conclusion

The PCE Index is seemingly stuck in a range of around 2.5% annual inflation rate. Further analysis shows the Housing and Utilities sector and the Financial Services and Insurance sector are the main influences keeping the PCE Index at this 2.5% range. The good news is that these sectors are trending in the correct direction. However, the future wildcard with the PCE Index is the effect on tariffs on the economy and the overall inflation rate.

—Tom Schaefges, St. Onge Company